Now that you have decided that you are indeed running a business and you need to register as self-employed; the process is pretty straight-forward. It is important to know that you must register by 5th October of your second year of trading, but it is advised that you register a lot sooner, and preferably within 3 months of starting your business.

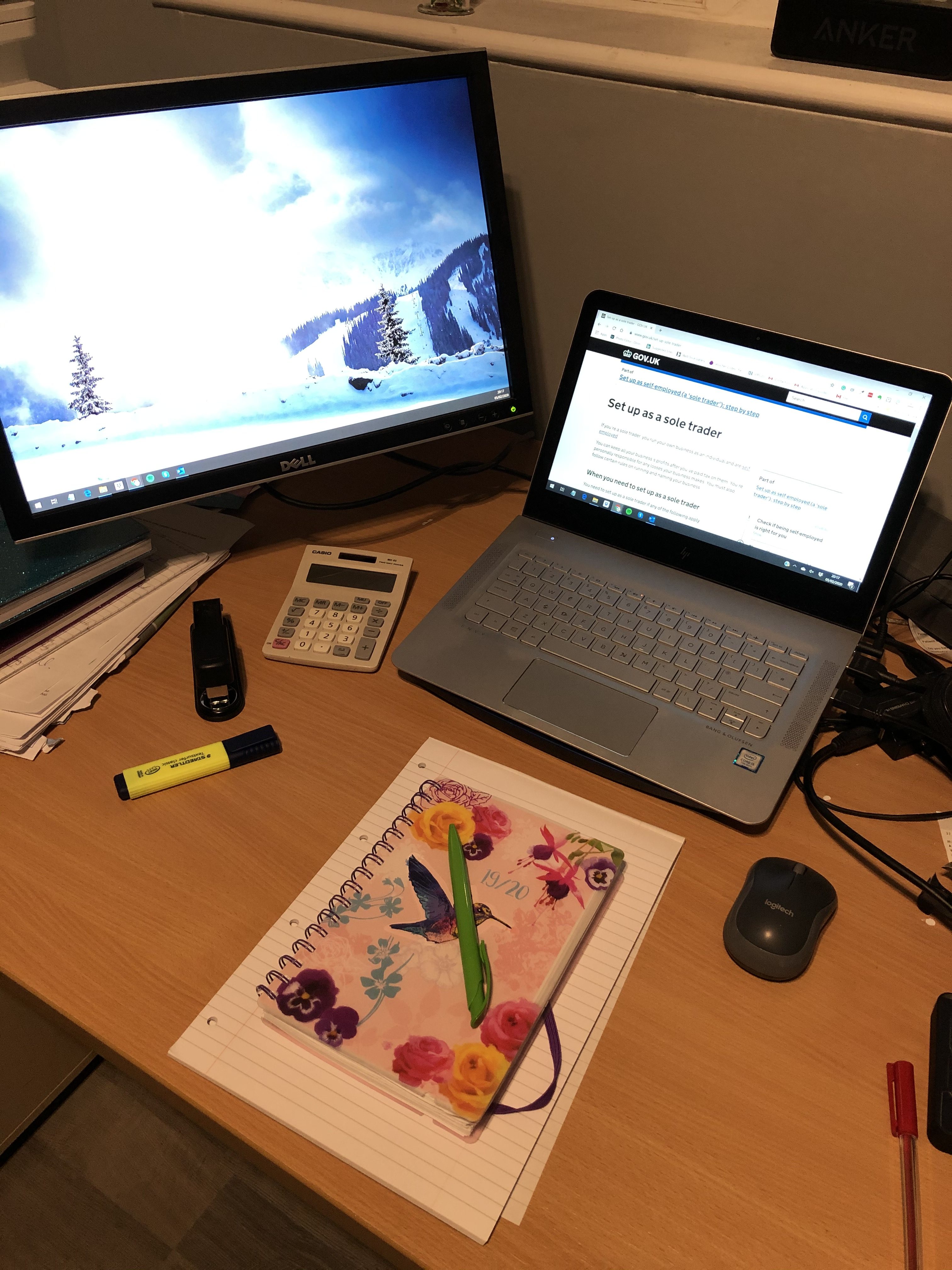

To register as self-employed go to https://www.gov.uk/set-up-sole-trader, click on the link within the article, “Register for Self Assessment”, and follow the steps. Once you have submitted the information, HMRC will post out your Unique Taxpayer Reference (UTR) and login details for Government Gateway. After you receive this information, you need to log onto your Government Gateway Account and complete your registration.

You may also need to consider the following:

1) Registering for VAT if your turnover is above the VAT threshold which has been £85,000 since 01/04/2017.

2) Registering for the Construction Industry Scheme if you are working as a contractor or sub-contractor in the construction industry.

3) Registering as an employer if you will be employing staff.

Once you are registered you will need to keep track of all income and expenses for the business so that you are able to file your Self-Assessment Tax Return and pay Class 2 and Class 4 National Insurance Contributions.

To make it easier to keep your business records straight, it helps if you separate them from your personal records. One way to do this is by setting up a separate bank account and/or PayPal account. This will ensure that only business transactions are tracked and make it easier for you to complete your accounts.

The amount of tax you will pay will depend on the profit of the business – this is calculated by subtracting allowable business expenses from your income. You are then taxed on the taxable profit. The tax-free personal allowance for both the 2019/2020 and 2020/2021 tax year is £12,500. After that, you will pay 20% tax up to £50,000, 40% tax on income over £50,000, and then 45% tax on income over £150,000.

Watch for my next blog post which will cover what you can claim as self-employed.