Bookkeeping, a word that instils fear and panic in thousands of small business owners. I am here to help allay some of that fear by helping you to understand the basics of bookkeeping.

The first thing that you need to understand is that proper bookkeeping is essential to every business and if you ever get to the point where you just aren’t able to devote the time to do it properly or are struggling to understand what needs to be done, you should find a qualified bookkeeper who can help you.

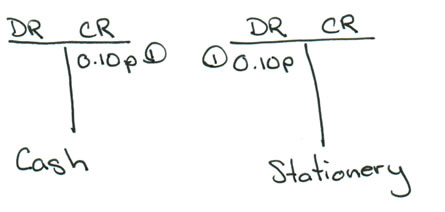

Bookkeeping is based on the double-entry system – money comes in, but it also goes out. Every transaction must have a two-sided entry. These two sides are known as Debit (DR) and Credit (CR). For each transaction, the DR side must equal the CR side. For example, if you buy a pencil for 10p, you have paid money out but have also gained a pencil.

| DR Stationery | 0.10p |

| CR Cash | 0.10p |

| purchase of a pencil | |

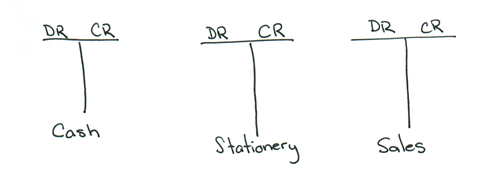

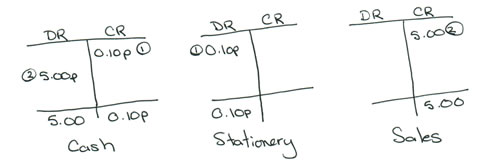

A very simple way to start keeping your records is to use a pen and paper and to use T-accounts. Set up each account (Cash, Stationery, Sales, etc) as a T-account with one side as the Debit side and one as the Credit Side.

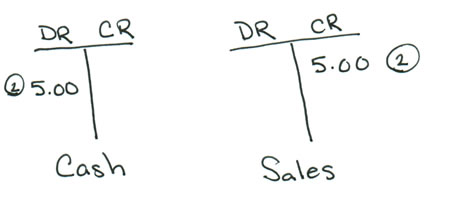

When you enter a transaction assign a number to it so that you can find both corresponding entries. You also need to make sure you date your entries.

When you enter a transaction assign a number to it so that you can find both corresponding entries. You also need to make sure you date your entries.

Here is an example of how to record a sale. You make a sale of £5.00:

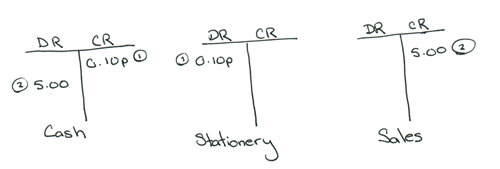

All of your T-accounts now look like this:

At the end of each month, total up each T-account. The total DRs should equal the total CRs.

| Total DRs = | £5.10p |

| Total CRs = | £5.10p |

Using T-accounts is a very simple way to keep track of your accounts.

Lesson 2 will look at the different types of accounts: Assets, Expenses, etc.

If you have any questions on today’s lesson, or would like help answering other bookkeeping questions, please leave a comment below or contact us via the Contact Us Page, our Facebook Page, or on Twitter.