After I gained my ProAdvisor certification with QuickBooks Online, I wanted to do the advanced certification, but it was only offered in a classroom-based setting which unfortunately wasn’t suitable for me due to my mobility issues. There was talk of them eventually doing the training over distance learning so I was eagerly awaiting that day.

It happened by chance that I saw a post from someone on a Facebook group I use, saying that two of the QBO trainers were going to be offering the Advanced Certification through a series of webinars. I signed up to do the courses straight away and counted down the days before they would start.

The training was offered over 4 2-hour long webinars and each session had a booklet that you would need to work through. You had to complete each workbook before moving onto the next session. Before starting the webinars there was a pre-workbook to complete which was basically just getting the training company file created on the online portal. Each session covered several topics that went further than the basic training.

Session 1 covered setting up a company, the best order for importing data, importing customers and suppliers and how to deal with special accounts when setting a company up. I’ve already set up a few client accounts on QBO, but I did find this more in-depth look at the process to go through very useful and will be ensuring I follow this process for any future accounts I set up.

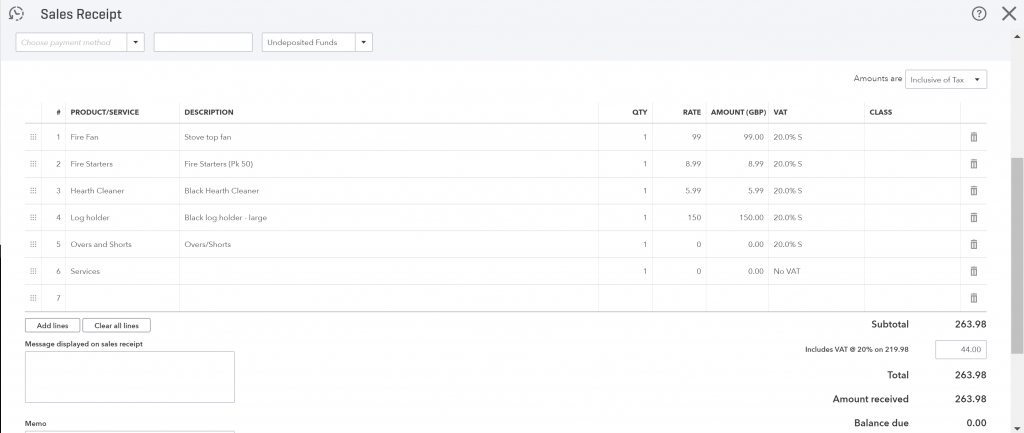

Session 2 covered complex banking transactions like ones you would need to deal with if you had a retail client (so till receipts for example), job costings and using sub-customers, timesheets, foreign transactions, PayPal, banking rules, and many other topics. It was quite a coincidence that just as I was learning about how to deal with retail clients that I actually signed up my first retail client! I’ve already put the template in place for dealing with Till Receipts as per the instructions from the course, and have found it extremely useful.

Session 2 covered complex banking transactions like ones you would need to deal with if you had a retail client (so till receipts for example), job costings and using sub-customers, timesheets, foreign transactions, PayPal, banking rules, and many other topics. It was quite a coincidence that just as I was learning about how to deal with retail clients that I actually signed up my first retail client! I’ve already put the template in place for dealing with Till Receipts as per the instructions from the course, and have found it extremely useful.

Session 3 focused on special VAT set-ups – so how do to do corrections, the different rates, EC sales lists, partial exemption and the Flat Rate Scheme. It also looked at period end and the various things you need to look at when closing off a set of accounts, and special company setups like charities and legal practices. The VAT section was really good and I know I will be using a lot of the tips from this for my VAT registered clients. The section on the Period End showed me a lot of tools on QBO that I didn’t know about – things like how to merge debtors/creditors/nominal accounts and how to reclassify transactions. The reclassifying tip is one I will most definitely be using with clients when we discover incorrectly coded transactions.

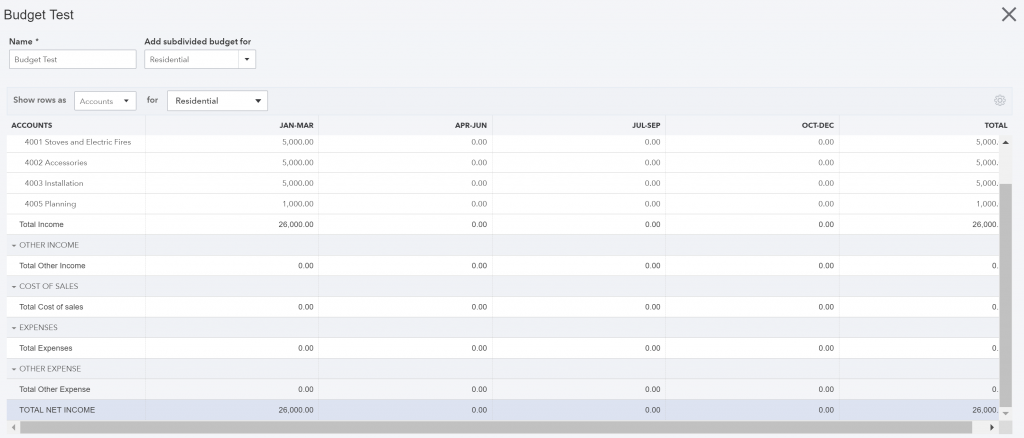

Session 4 was all about reports – budgets, how to customise reports, and management reporting. I am hoping I will be able to help my clients to use all of the features of QBO to their fullest. There are a lot of great reports in the software that can give you a very in-depth look at the financial position of your business and I look forward to helping my clients discover them.

Session 4 was all about reports – budgets, how to customise reports, and management reporting. I am hoping I will be able to help my clients to use all of the features of QBO to their fullest. There are a lot of great reports in the software that can give you a very in-depth look at the financial position of your business and I look forward to helping my clients discover them.

At the end of the final session we were provided with information on how to access the exam. Before I requested access, I rewatched the webinars to make sure I did not miss anything. The exam was broken down into 7 sections and you were allowed to use your notes to help you. There were a couple of questions I wasn’t 100% sure on, but at the end of the 2 hours I was rewarded with a very good mark and am now an Advanced Certified ProAdvisor.

I am looking forward to putting everything I’ve learned into place so that I can help my bookkeeping clients to grow their business. I am always on the lookout for further training that I feel will be beneficial to my clients.

If you would like to contact me to discuss how I can help you with your accounts, send me an email to info@ihelm-enterprises.co.uk.